Mastering the Art of Changing a Stop Loss Order -662849358

Mastering the Art of Changing a Stop Loss Order

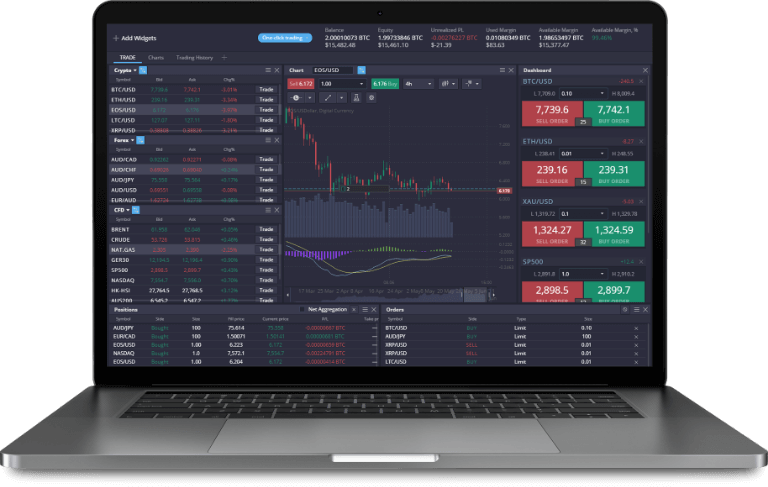

In the dynamic world of trading, one of the most critical aspects of a successful trading strategy is managing risk. A stop loss order is a crucial tool for traders, allowing them to limit potential losses on a trade. However, knowing when and how to change a stop loss order is equally important. This article delves into the nuances of changing a stop loss order, offering insights that can enhance your trading experience and strategies. Don’t forget to check out changing a stop loss order after it’s placed on primexbt trading bonuses PrimeXBT for great opportunities that can complement your trading journey.

What is a Stop Loss Order?

A stop loss order is a predetermined price level that a trader sets to close a position automatically when the market moves against them. This vital risk management tool helps traders mitigate losses by exiting a losing trade before it becomes even more detrimental to their capital. For instance, if you’ve bought a stock at $50, you might set a stop loss at $45. If the stock price drops to $45, your order will execute, preventing further losses.

Why Change a Stop Loss Order?

While setting a stop loss order is essential, it’s not a ‚set it and forget it‘ strategy. As market conditions change, you might want to adjust your stop loss orders for several reasons:

- Market Volatility: In highly volatile markets, the price may swing widely. Adjusting your stop loss can help you avoid getting stopped out prematurely.

- Shift in Analysis: If your market analysis indicates a change in trend, you might want to revise your stop loss to align with your new perspective.

- Profit Protection: As a trade moves into profit, it’s prudent to adjust your stop loss to lock in gains and reduce potential risk.

How to Change a Stop Loss Order

Changing a stop loss order typically involves a few straightforward steps, depending on the trading platform you are using. Here’s a general guide:

- Access Your Trading Platform: Log in to the trading platform where you hold your position.

- Navigate to Open Orders: Find the section where your active trades are displayed.

- Select the Trade: Choose the trade for which you want to change the stop loss order.

- Edit the Stop Loss: Click on the option to modify or edit your stop loss order. Enter the new stop price based on your revised strategy.

- Confirm the Changes: Review the changes and confirm them to ensure your stop loss is updated as per your intention.

Best Practices for Adjusting Stop Loss Orders

While changing a stop loss order, following best practices is crucial to maximize your trading success:

- Be Strategic: Don’t adjust your stop loss based on emotions like fear or greed. Make changes based on analytical assessments and strategies.

- Use Trailing Stops: A trailing stop loss automatically adjusts as the price moves in your favor, allowing you to lock in profits while still protecting against losses.

- Monitor Market Sentiment: Stay updated on news and market conditions that may impact your trades, and adjust your stop loss accordingly.

- Maintain a Risk-Reward Ratio: Always keep your risk-reward ratio in mind when setting and adjusting stop losses to ensure it aligns with your trading goals.

Common Mistakes to Avoid

Many traders fall into traps that can lead to unnecessary losses when managing stop loss orders. Here are some common mistakes to avoid:

- Chasing the Price: Avoid moving your stop loss order too close to the current price simply because the market is moving against you.

- Setting Stop Losses Too Tight: While it’s essential to protect your capital, placing your stop loss too close can lead to being stopped out in normal market fluctuations.

- Neglecting to Adjust: Failing to change your stop loss as market conditions evolve can leave you vulnerable to greater losses.

Conclusion

Changing a stop loss order is a pivotal part of effective risk management in trading. By understanding the reasons for making these adjustments and implementing them wisely, you can enhance your trading outcomes. Remember to remain disciplined, apply best practices, and continually educate yourself about market dynamics. With the right approach, adjusting stop loss orders can be an invaluable strategy in navigating the complexities of trading.

Otváracie hodiny

Otváracie hodiny:

Pondelok – Piatok: 10:00 – 22:00

Sobota – Nedeľa: 11:00 – 22:00

Opening hours

Opening hours:

Monday – Friday: 10:00 to 22:00

Saturday – Sunday: 11:00 – 22:00